Record Listings, Retail Surge, and What Comes Next

The Indian Initial Public Offering (IPO) market had a landmark year in 2024, exceeding expectations and setting new records. Driven by a surge in retail investor participation and favorable economic conditions, the IPO market witnessed a significant increase in both the number of listings and the amount of capital raised. This analysis delves into the key trends, successes, and failures that shaped the IPO landscape in India in 2024, providing insights into the factors that contributed to this remarkable performance and offering an outlook for the future.

Overview of the IPO Market in India in 2024

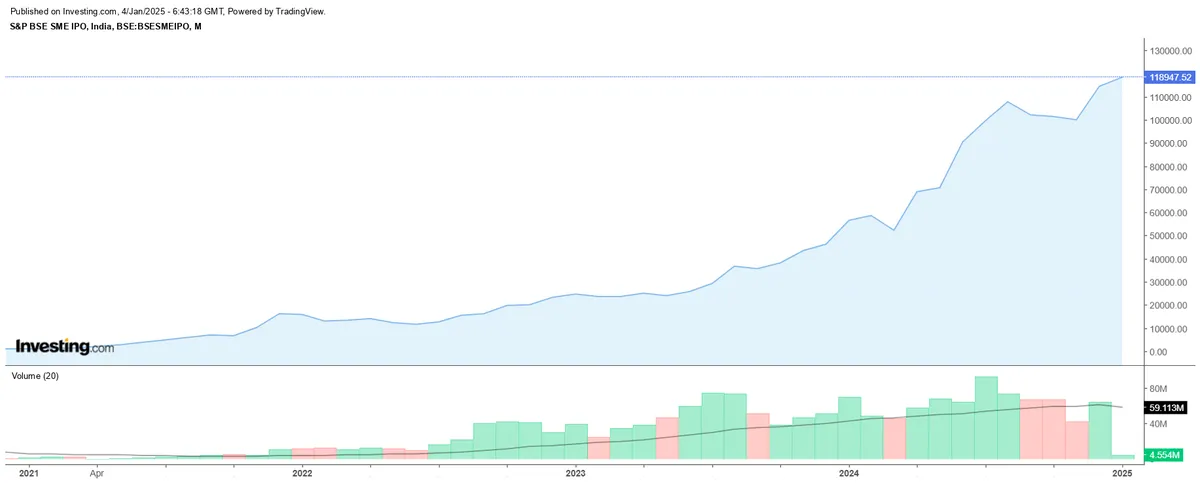

2024 was a year of resurgence for the Indian IPO market. A record-breaking 333 IPOs (90 mainboard and 243 SME) raised ₹1.8 trillion (approximately $22 billion USD), surpassing the previous high of ₹1.3 trillion set in 2021.

Factors Driving IPO Growth

- Strong Economic Fundamentals: Infrastructure investment, manufacturing growth, and consumer spending created a fertile environment.

- Increased Investor Participation: Retail and HNI investors actively sought alpha through IPOs.

- Favorable Regulatory Environment: SEBI eased access to capital markets.

- Positive Market Sentiment: Bullish equity market encouraged listings.

India's Global Position

India emerged as a global IPO leader in 2024, outpacing the U.S. and Europe in number of listings. Average returns stood at 37.1% in India vs 20.6% in Europe.

Historical Context and Recent IPOs

The S&P BSE IPO Index continued its upward trend. Notable late-year listings like Unimech Aerospace and Senores Pharmaceut posted listing gains of 89.94% and 51.84% respectively.

Investment Limits for Retail Investors

Minimum investment: ₹10,000–₹15,000 depending on lot size. Maximum: ₹2 lakh per IPO.

Expert Opinions and Outlook for 2025

- Trivesh D (Tradejini): Warns of a potential SME IPO bubble and advises focusing on strong mainboard IPOs.

- Narendra Solanki (Anand Rathi): Expects continued vibrancy and resilience.

- Prashanth Tapse (Mehta Equities): Predicts IPO momentum will continue.

- Himanshu Kohli (Client Associates): Notes growing domestic capital strength reducing FII dependence.

Top Performing IPOs of 2024

| Company | Listing Date | Issue Price (₹) | Listing Price (₹) | Gain (%) |

|---|---|---|---|---|

| Premier Energies | Sep 27 | 450 | 1324.70 | 194.38% |

| Bharti Hexacom | Apr 12 | 570 | 1494.70 | 162.23% |

| Waaree Energies | Feb 6 | 316 | 650.45 | 105.84% |

| Jyoti CNC Automation | Mar 20 | 670 | 2367.40 | 253.34% |

Why they succeeded: Strong financials, attractive pricing, and sectoral tailwinds (notably renewable energy).

Underperforming IPOs of 2024

| Company | Listing Date | Issue Price (₹) | Listing Price (₹) | Loss (%) |

|---|---|---|---|---|

| Popular Vehicle | Jul 17 | 295 | 160.37 | -45.64% |

| Capital Small Finance Bank | Jul 24 | 468 | 284 | -39.32% |

| Western Carriers | Sep 18 | 172 | 119.47 | -30.54% |

| M.V.K. Agro | Mar 7 | 120 | 82.95 | -30.88% |

| Fedbank Financial | Oct 29 | 140 | 97.79 | -30.15% |

Why they failed: Overvaluation, weak fundamentals, and adverse market sentiment.

Performance in Subsequent Weeks

Top gainers like Premier Energies and Bharti Hexacom held their momentum. Underperformers like Popular Vehicle continued struggling post-listing. Volatility remains a factor, reinforcing the need for cautious investing.

Key Trends from 2024

- SME Boom: 243 SME IPOs raised ₹9,000+ crore.

- Sectoral Spread: Tech, renewable energy, and BFSI led activity.

- Retail Power: Retail drove demand and oversubscriptions.

- Focus on Fundamentals: Investors more discerning, avoiding hype.

Conclusion

2024 marked a watershed moment in India’s IPO evolution. The confluence of macroeconomic growth, regulatory support, and retail enthusiasm created an unprecedented year. Going into 2025, vigilance is required—especially in the frothy SME segment—but the long-term fundamentals of India’s capital markets remain robust.

As India grows and financializes, the IPO market will continue to be a key vehicle for both capital formation and wealth creation—if investors, founders, and regulators all play their part wisely.